After you do so, choose Insert, Name, Define, and then enter the three names that follow.ĭay =MIN(DAY(DATE(YEAR(Report!R6C),MONTH(Report!R6C)+1,1)-1),Report!RC4)

This allows you to enter the names as shown below. You also will find the name easier to enter if you name your worksheet Report, as I did. After you have entered the three names, remove the check mark from R1C1 reference style. In the General tab, put a check mark by the Setting of the R1C1 reference style. To use R1C1 references, choose Tools, Options. You will find these easier to use if you define them as the range names that follow.Īnd you will find these definitions easier to enter if you use R1C1 references rather than A1 references. To do so, the formulas must calculate several intermediate results. Define the Range NamesĮach formula in the Monthly Payments Section decides whether it’s time to pay the amount specified in column G in the figure shown below. Second, they can serve as a checklist to ensure that payments are made. First, they help you to track your weekly cash requirements more accurately. The bottom section handles checks paid on a weekly schedule. The top section handles checks that are paid on a monthly schedule. To return to this page, click the Back button on your browser.) (To see a full-size copy of this report, click on it with your mouse pointer. In addition to providing information about each required payment, each of the two sections shows the week in which the payment is due. This figure shows an Excel spreadsheet that tracks periodic cash requirements automatically. Often, their accounting systems provide little help in keeping track of these requirements. The first step is to calculate the amount that you are going to pay for the 1st month of the lowest debt.Most companies must write checks periodically to companies that don’t send invoices. Step 1: Calculate Payment Amount for 1st Month of Lowest Debt Additionally, I have a one-time payment of $100 too.

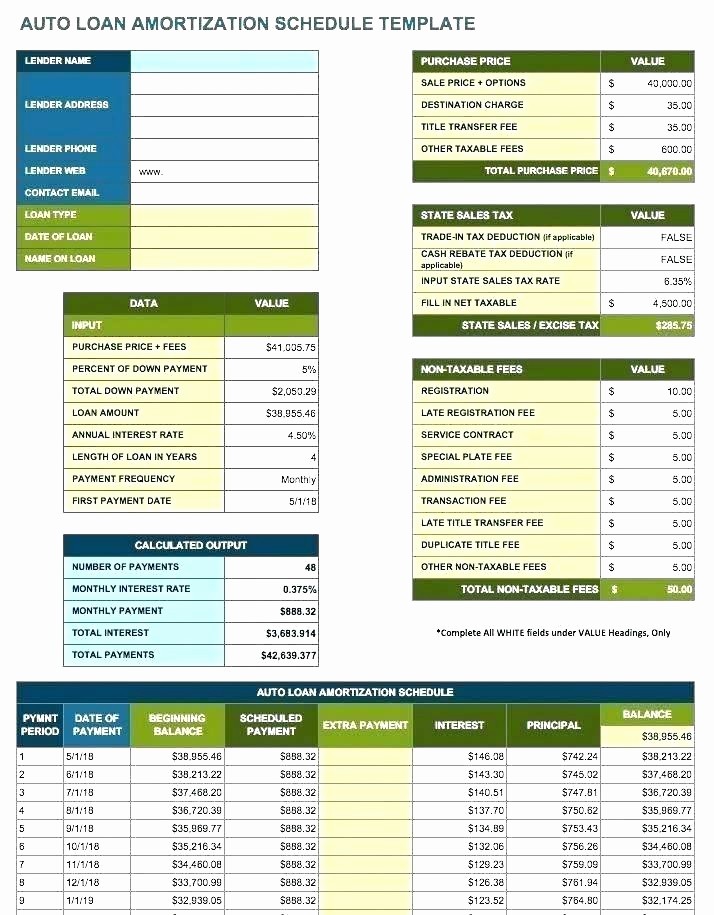

After a minimum payment of $100 for each loan, there will be an extra $(500-3*100) or $200 which will be used for the lowest debt. Please note that the total payment each month is $500. I will show the repayment schedule of these debts using the snowball payment calculator in Excel. Thus, it creates a snowball effect to make the payment faster.ġ2 Steps to Create Snowball Payment Calculator in Excel Whenever we finish paying the lowest debt, then this amount will be applied to the second-lowest debt. This additional amount will be applied to the lowest debt. Then, you will pay the total minimum amount of $6 and may choose to include additional money towards the $10 debt. If you have three outstanding debts of $10, $20, and $30, the minimum payment is $2 for each. The Snowball method is a loan repayment method where you pay a minimum amount to every loan and use the rest of the amount to repay the lowest loan.

0 kommentar(er)

0 kommentar(er)